The context in UX: brilliant functionality to call out stock price predictors

October 2022 2 min read

Stock prices go up and down all the time, it's a modus operandi for open financial markets. If you know what a stock price will be, you're having an ethereal power and can get rich fast. If you're mistaken, you can loose everything. There are arguments that stock prices are exhibiting a "random walk" so they're unpredictable. While some traders believe in patterns that stock prices take, like Elliot Waves. Meanwhile there's a market of trade advices to help you. Or to mislead you?

One of the websites that provides information for retail traders and trade advice is Seeking Alpha. They have a feed with predictions and analysis sourced by authors that usually represent a firm or are advisors themselves. With investment advice it's always puzzling of who to listen, as at a particular point of time on one topic you can get two diametrally different opinions. One say Buy, another say Sell and reading through doesn't help that much as both are well written, analysis are fact-based, judgements are sound.

Seeking Alpha provides a context for a reader to understand the source of information better:

- What is the past performarce of the predictor?

- What is his/her the investment time horizon?

To find out:

- If his/her advise suits me?

- Can I trust him/her?

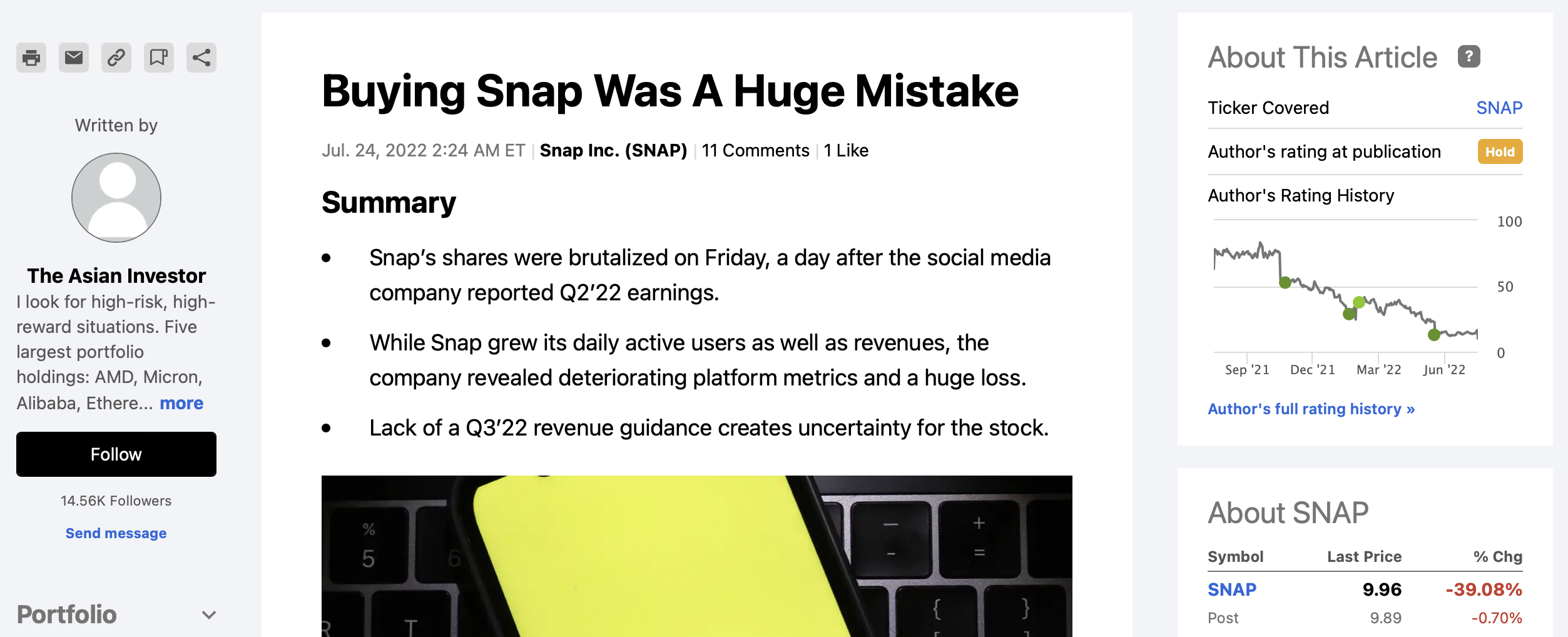

Each article supplied with a simplified recommendation: Sell, Buy or Hold. Then you see a historical price movement of a discussed stock and previous recommendations of this advisor.

Before reading the advice we check the content block above to get important context about the author. At this article he advises to Hold the stock. We see that he writes mostly after the stock dropped significantly and the advice is always the Strong Buy. The idea is simple, after a significant drop, a stock should bounce back, but for SNAP it didn't happen. Only once it bounced back then to keep declining.

It turns out that if you're an investor with a 1+ month time horizon, you'd be constantly loosing money by following advices of this author as when he advises Strong Buy it's actually better to Sell.

Lesson learned

Providing a context is a powerful way to deliver additional value or even build up a differentiation as in the abovementioned example with Seeking Alpha. It's important to understand what job your user would like to get done with the functionality you provide.

As the afterword I'd like to share the video by Kate Moran on why in UX Design it's no silver-bullet approach and you should think through each time, even if you crated the same functionality before. Each time the context is unique and it changes everything: